Nowadays, there are many businesses that have been established. Opening a new company bank account in your transaction after the establishment of the enterprise will show its professionalism. Moreover, it will help to manage salary payments conveniently and pay or receive payment in case of long-distance from partners. In this below article, DNBC Financial Group will show you how to open a company bank account in just some easy steps.

How to open a business account in just some easy steps?

What is a company bank account?

A company bank account is a type of payment account opened at a bank for the purpose of receiving, sending, paying and withdrawing money. Through a bank account, businesses deposit money and authorize the management of this money to the bank. Businesses can use their bank accounts to transfer, make payments, withdraw money, etc., at any time.

Is it necessary to create a company bank account?

Nowadays, 90% of tax departments require businesses to pay taxes through electronic tax payments to minimize the overload of administrative procedures. Bank accounts also help businesses more conveniently in transactions with customers and partners. Opening a bank account is essential for businesses.

6 Benefits of a company bank account

Your business could appear more professional

Image is considered the most important in business, and having a separate business bank account can help to create a more professional image when dealing with suppliers and clients. It could help to build up your credibility and make you appear more trustworthy to clients, who may feel reluctant to send payments to a personal account.

Cost-savings for businesses

According to statistics, enterprises using Internet payment services on average increased by 11.58% per year. And customers using mobile payment services on average increased by 10.5% per year. This is also the payment channel chosen by many businesses to minimize operating costs in the context of difficult market conditions. And business units only need to open an account at a bank to receive many accompanying benefits.

Avoid tax issues

Maintaining a separate business bank account makes it easier to track business earnings and expenditures. This can save you a lot of headaches when you go to file your taxes. Separating your personal and business finances indicates to the government that you’re running a legitimate business and not a hobby business, which is not permitted business tax deductions.

Separate business credit

A business credit card stands on its own, meaning your personal credit rating is not reflected in your transactions. In addition, by having a separate credit card for a small business, you no longer have to sort out business and personal transactions when it is time to pay taxes.

Handling expenses easier, more organized

Having a bank account devoted to your business makes it simpler to keep track of your costs, control your spending, and avoid unintended overspending, all of which are critical to the success of any small business. So, too, are reports and statements that accurately represent the status of your firm.

Clean financial records

The main reason why it is advisable to open a business bank account is that it alleviates the problems that arise from mixing your personal and business finances.

Opening a business account can help you keep your business and personal expenses separate, allowing you to keep track of your business’s cash flow. You will also have a better way to manage your budget with a clear overview of your earning and spending.

Keeping your personal and business bank accounts separate will help you manage and organise what’s needed for taxes and deductions at the end of the year. You will also have a clear audit trail.

3 steps to open a company bank account?

First step: Choose a bank

Choosing a bank before creating your business bank is very important. Nowadays, there are many banks for businesses to choose from, but the procedure for opening a corporate account of each bank may be different, and the director must go directly to the Bank to do the procedure. However, Enterprises should refer to the services and utilities of each Bank to meet the maximum needs of enterprises. In addition, enterprises should also choose banks with transaction offices, headquarters, or branches close to the enterprise’s headquarters to facilitate transactions.

Second step: Prepare documents

The bank employee will give you some information about documents to open a company bank account. Such as:

- Application form for opening an account (made according to the form): The customer will provide full information about the business, including transaction name, head office, transaction address, telephone and fax numbers, a field of operation, and legal representative information.

- Documents certifying that the enterprise is legally established and operating: Establishment decision, operation license, business registration certificate.

- Identity card or passport of the legal representative of the business

Third step: Verify everything is correct

If you opened a business checking account, make sure the names on the checks match your business’s legal name, not your business name. Make sure your deposits go through. Track the funds coming in and out of your account to make sure everything runs smoothly.

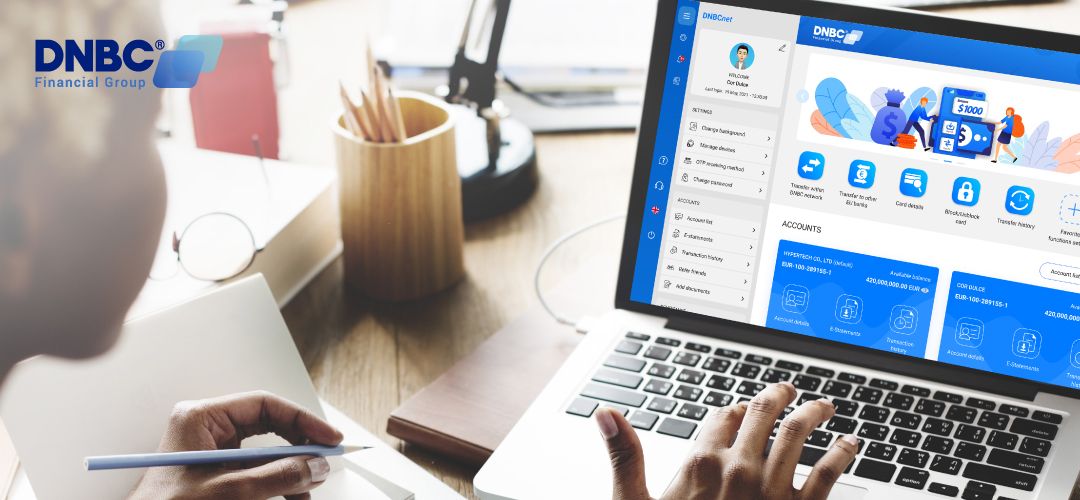

About DNBC Financial Group

The DNBC Financial Group is a financial organization that operates in the global financial market. Our mission is to deliver the best possible payment services at a reasonable cost. With a readily available online platform, we can save you time, money and countless trips to your local banks. At DNBC, we support opening business accounts online, you can find the “Open an Account” option on the top right of our website.

Or please contact DNBC

![]() Email: [email protected]

Email: [email protected]

![]() Phone Number:

Phone Number:

- +65 6572 8885 (Office)

- +1 604 227 7007 (Hotline Canada)

- +65 8442 3474 (WhatsApp)

DNBC Team

DNBC Team