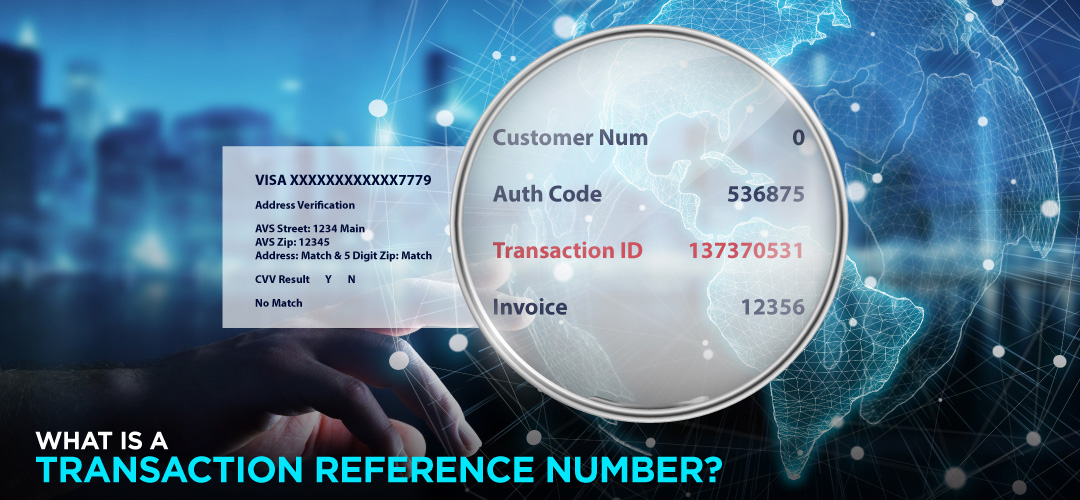

A transaction reference number (TRN) is an important element for any financial transaction and serves as a reference point for both the sender and the receiver.

Without a TRN, it can be difficult to track a transaction and ensure that it has been processed correctly, making it an essential part of any financial transaction.

What is a transaction reference number?

A TRN is a unique identifier assigned to a financial transaction, such as a wire transfer, online payment, or credit card transaction.

TRN is provided to both the sender and receiver as proof of the transaction, to track the progress of the transaction and to verify the amount transferred, and confirm the account details of the recipient.

TRN can be generated by banks, financial institutions, and other service providers, and are typically alphanumeric codes that may include a combination of letters, numbers, and symbols.

In some cases, the transaction reference number may also be required when disputing a transaction or when providing proof of payment for a particular transaction.

What is a transaction reference number?

What kinds of transaction reference numbers?

There are several types of transaction reference numbers depending on the type of transaction and the financial institution involved.

Here are some common types:

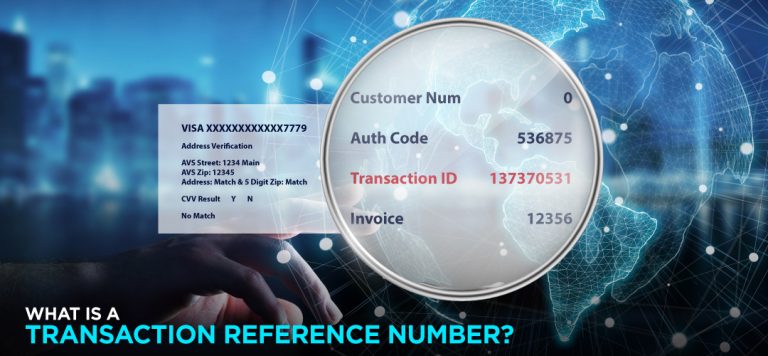

Bank reference number

This is a unique identifier assigned by a bank to a transaction. It helps the bank to trace the transaction in case of any issues or disputes.

Order reference number

This is a number assigned to an order placed by a customer. It is used to track the status of the order and to reference the order in communication between the customer and the seller.

Payment reference number

This is a number assigned to a payment made by a customer. It is used by the recipient to identify the payment and allocate it to the appropriate account.

Transaction ID

This is a unique identifier assigned by a payment processor or a financial institution to a transaction. It is used to track the status of the transaction and to reference the transaction in communication between the parties involved.

Invoice number

This is a unique identifier assigned to an invoice by the issuer. It is used to track the payment of the invoice and to reference the invoice in communication between the parties involved.

How to find a transaction reference number?

The method for finding a transaction reference number can vary depending on the type of transaction and the institution involved.

Here are some common ways to find a transaction reference number:

Check your receipt or confirmation email

If you made a purchase or completed a transaction online, you may have received a confirmation email or receipt that includes a transaction reference number.

Look for the number on your bank statement

If the transaction involves a bank transfer or debit/credit card payment, you should be able to find the transaction reference number on your bank statement.

Contact customer service

If you are unable to locate the transaction reference number using the above methods, you can contact the customer service department of the institution involved (such as your bank or the merchant you made a purchase from) and request the number.

Check your online account

If you made the transaction through an online account, you may be able to find the transaction reference number by logging into your account and viewing the transaction history.

It is important to keep the transaction reference number in a safe place and to provide it to the recipient when transferring funds to ensure a smooth and secure transaction.

Or please contact DNBC

![]() Email: [email protected]

Email: [email protected]

![]() Phone Number:

Phone Number:

- +65 6572 8885 (Office)

- +1 604 227 7007 (Hotline Canada)

- +65 8442 3474 (WhatsApp)

DNBC Team

DNBC Team